Investment Property in Navi Mumbai – Complete Guide (2025–26)

Navi Mumbai has emerged as one of India’s most promising real estate investment destinations. With massive infrastructure development, excellent connectivity, and relatively affordable property prices compared to Mumbai, it offers a strong combination of capital appreciation, rental income, and long-term security.

Whether you are a first-time investor or a seasoned buyer, Navi Mumbai provides multiple investment options across residential, commercial, and land segments.

Why Invest in Navi Mumbai?

1. Infrastructure-Led Growth

Large-scale infrastructure projects such as the international airport, metro expansion, Mumbai Trans Harbour Link (MTHL), expressways, and upgraded highways are transforming Navi Mumbai into a future-ready city. These developments significantly increase property demand and prices.

2. Planned City Advantage

Navi Mumbai is a well-planned city with wide roads, organized sectors, green spaces, reliable utilities, and dedicated residential and commercial zones. This planned growth ensures better quality of life and stable long-term appreciation.

3. Affordable Entry Compared to Mumbai

While Mumbai property prices range between ₹25,000–₹60,000 per sq.ft, Navi Mumbai still offers investment opportunities between ₹7,000–₹15,000 per sq.ft, making it attractive for investors looking for value and growth.

Best Locations for Property Investment in Navi Mumbai

Kharghar

Kharghar is one of the most developed nodes in Navi Mumbai. It has strong social infrastructure, educational institutions, and steady rental demand from families and professionals. It is ideal for investors seeking stable returns with moderate appreciation.

Ulwe

Ulwe is considered the fastest-growing investment zone due to its proximity to the upcoming international airport and MTHL. Property prices are still relatively affordable, making it ideal for long-term capital appreciation.

Panvel

Panvel benefits from excellent road and rail connectivity and strong airport influence. Both Old Panvel and New Panvel offer good opportunities for budget-friendly investments with long-term growth potential.

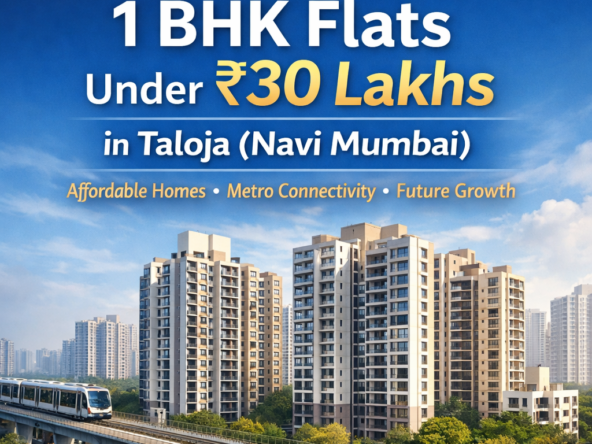

Taloja & Roadpali

These areas offer low entry prices and are gaining popularity due to metro connectivity and increasing residential demand. They are suitable for first-time and budget investors.

Vashi, Nerul & CBD Belapur

These are established nodes with corporate offices, malls, schools, and hospitals. They offer consistent rental income and lower investment risk.

Property Types & Investment Strategy

Residential Apartments

1BHK and 2BHK apartments are the most preferred investment options due to high demand, easy rental, and better resale value. Residential properties offer balanced risk and returns.

Commercial Properties

Commercial offices and retail spaces offer higher rental yields but require higher capital and careful location selection. Best suited for experienced investors.

Land / Plots

Plots near the airport corridor offer excellent long-term appreciation potential. However, they do not generate rental income and require strict legal verification.

Rental Yield & ROI

- Residential rental yield: 3% – 4%

- Commercial rental yield: 6% – 8%

- Expected appreciation (5 years): 15% – 30% (location dependent)

Things to Check Before Investing

- RERA registration

- Clear title and approvals

- Builder reputation

- Possession timeline

- Connectivity and rental demand

FAQs – Investment Property in Navi Mumbai

1. Is Navi Mumbai a good place for property investment in 2025–26?

Yes. Strong infrastructure growth and rising demand make Navi Mumbai one of the best real estate investment destinations in India.

2. Which areas are best for investment in Navi Mumbai?

Kharghar, Ulwe, Panvel, Taloja, Roadpali, Vashi, Nerul, and CBD Belapur are among the top investment locations.

3. What is the average property price in Navi Mumbai?

Prices generally range between ₹7,000 and ₹15,000 per sq.ft depending on location and project.

4. What rental yield can I expect?

Residential properties offer around 3–4% rental yield, while commercial properties may offer 6–8%.

5. Is Ulwe good for long-term investment?

Yes. Ulwe has high growth potential due to airport and MTHL connectivity and is ideal for 5–10 year investment horizons.

6. Ready possession or under-construction – which is better?

Ready possession is safer with immediate rental income, while under-construction properties offer lower prices and higher long-term appreciation.

7. Is Navi Mumbai suitable for first-time investors?

Yes. Areas like Taloja, Roadpali, and Panvel provide affordable entry points for new investors.

8. Are commercial properties safe to invest in?

Commercial properties can be profitable but involve higher risk and capital. They are best for experienced investors.

9. What legal checks are required before buying?

Verify RERA registration, title clarity, approvals, builder history, and agreement terms.

10. What is the future outlook for Navi Mumbai real estate?

The outlook is very positive, with expected appreciation of 15–30% over the next five years, driven by infrastructure and population growth.

Conclusion

Navi Mumbai offers a rare combination of affordability, strong infrastructure growth, stable rental demand, and long-term appreciation. For investors looking for a secure and future-ready real estate destination, Navi Mumbai stands out as an excellent choice.

Call / WhatsApp: 9321605435

Verified Properties | Zero Brokerage | NayeGhar.com