Introduction: Buying Your First Home Is Emotional — and Risky

Buying your first home in India is not just a financial decision; it is an emotional milestone.

For most Indian families, a home means security, stability, and pride.

But the reality is harsh.

Every year, thousands of first-time buyers:

- Choose the wrong location

- Trust the wrong builder

- Ignore legal checks

- Overstretch their budget

- Get trapped in delayed or disputed projects

This complete first-time home buyer guide is written to make sure you never repeat these mistakes.

Whether you are buying a flat in Navi Mumbai, Taloja, Panvel, Raigad, or any growing city in India, this guide will walk you step by step — from planning to possession.

1. Decide Your Purpose First: Living or Investment?

Before checking prices or visiting sites, ask one question:

👉 Why am I buying this home?

Buying for Self-Use

If you plan to live there:

- Prioritise connectivity

- Schools, hospitals, daily markets matter

- Builder reputation is critical

- Long-term comfort > short-term discount

Buying for Investment

If your goal is returns:

- Upcoming infrastructure is key

- Metro, highways, business hubs drive appreciation

- Rental demand matters more than luxury

💡 Pro Tip:

Most first-time buyers fail because they mix emotional buying with investment expectations.

2. Budget Planning: Don’t Buy What You Can’t Sustain

Your budget is not just the flat price.

Real Cost of Buying a Home

Include:

- Property price

- Stamp duty & registration

- GST (if under construction)

- Home loan processing fees

- Interior & furnishing costs

- Society maintenance

Safe Budget Rule

👉 Your total EMI should not exceed 30–35% of your monthly income.

If you earn ₹60,000/month:

- Safe EMI: ₹18,000–₹21,000

- Overstretching leads to stress and defaults

3. Home Loan Basics Every Buyer Must Know

4

How Much Loan Can You Get?

Banks usually finance:

- 75–90% of property value

- Based on income, age, credit score

Key Home Loan Tips

- Check loan eligibility before site visits

- Maintain CIBIL score above 750

- Compare interest rates (not just EMI)

- Ask about prepayment charges

💡 Getting a pre-approved loan gives you strong negotiation power.

4. Location Selection: Price Is Temporary, Location Is Permanent

A cheaper flat in the wrong area can destroy peace of mind.

What Makes a Good Location?

- Road + rail + metro connectivity

- Future development plans

- Job hubs within 60 minutes

- Social infrastructure

Example:

Areas like Taloja & Panvel gained attention mainly due to:

- Metro projects

- MIDC & commercial growth

- Affordable entry pricing

5. Builder vs Project: Both Matter

4

Never buy a project without checking the builder’s track record.

Builder Checklist

- Past delivery record

- Construction quality

- Financial stability

- Transparency in communication

Project Checklist

- RERA registration

- Clear land title

- Approved plans

- Amenities promised vs delivered

6. RERA: Your Biggest Protection as a Buyer

The Real Estate Regulatory Authority (RERA) exists to protect buyers.

Why RERA Matters

- Builder cannot delay without penalty

- Carpet area transparency

- Legal accountability

- Project details are public

👉 Always verify:

- RERA number

- Completion date

- Approved layout

Never trust verbal promises.

7. Under Construction vs Ready Possession

Under Construction – Pros & Cons

Pros

- Lower price

- Flexible payment plans

- Higher appreciation potential

Cons

- Construction risk

- Possession delays

Ready Possession – Pros & Cons

Pros

- Immediate possession

- What you see is what you get

- No GST

Cons

- Higher cost

- Limited choice

💡 First-time buyers who fear risk often prefer ready possession, while investors prefer under construction.

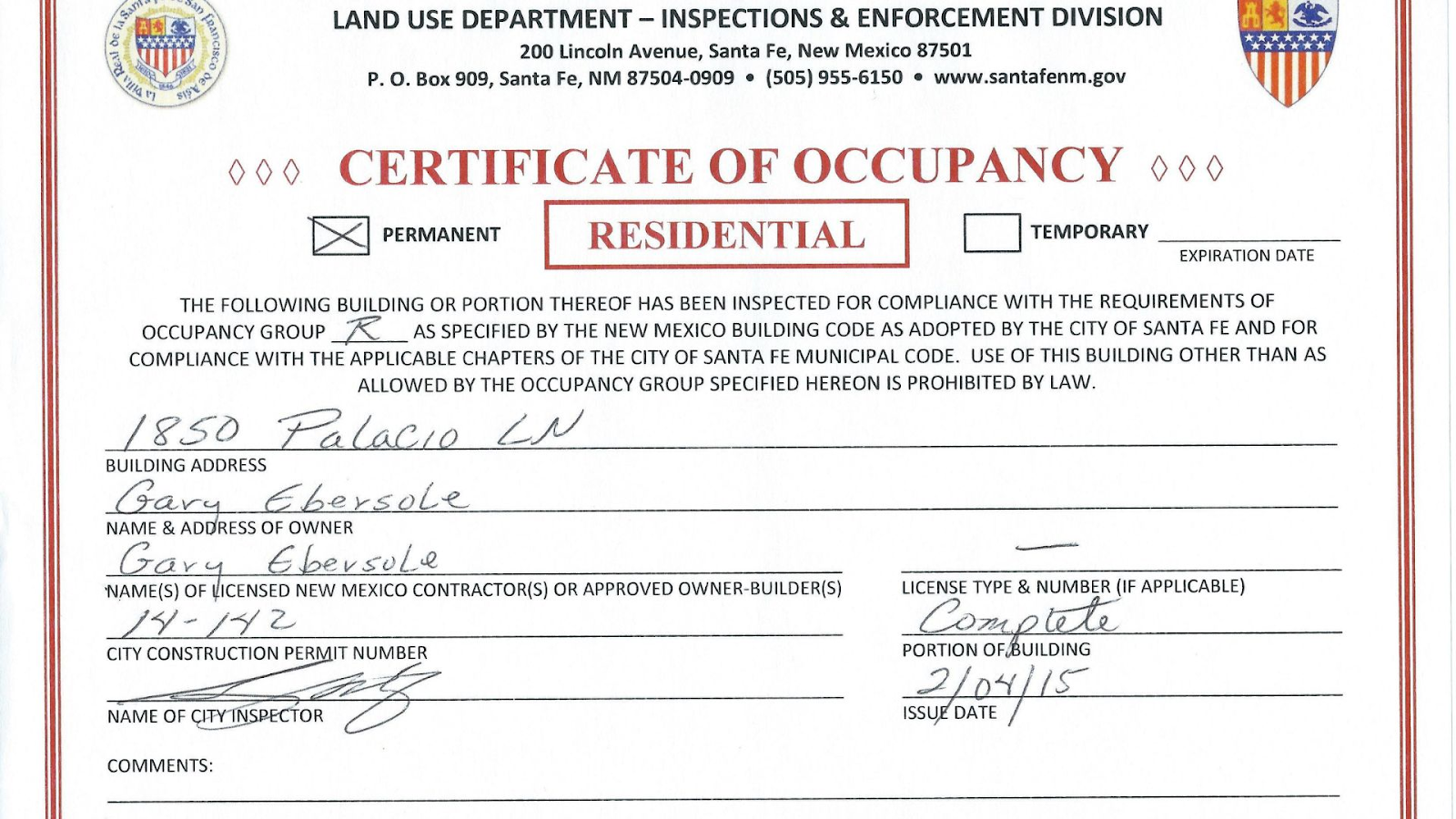

8. Documents You Must Verify Before Paying Booking Amount

4

Mandatory Documents

- RERA certificate

- Title clearance

- Approved building plan

- Agreement for Sale

- Occupancy Certificate (OC)

- Completion Certificate (CC)

Never rely only on the sales executive’s words.

9. Site Visit: Ask These Smart Questions

During site visits, ask:

- Exact carpet area

- Possession timeline

- Penalty clause for delay

- Maintenance charges

- Parking allocation

Take photos, videos, and written commitments.

10. Why First-Time Buyers Should Use a Trusted Property Platform

Searching property randomly is risky.

A trusted platform helps you:

- Compare verified listings

- Avoid fake offers

- Get transparent pricing

- Connect with genuine builders & agents

👉 On NayeGhar.com, buyers can explore verified properties, connect with trusted agents, and get expert guidance — all in one place.