“A Guide to Real Estate Investment for NRIs: What Types of Properties Can You Buy?”

Introduction:

- Start with a welcoming message addressing NRIs (Non-Resident Indians) who are considering real estate investments in India.

- Briefly mention the booming real estate market in India and the opportunities it presents for NRIs.

Content Body:

- Residential Properties:

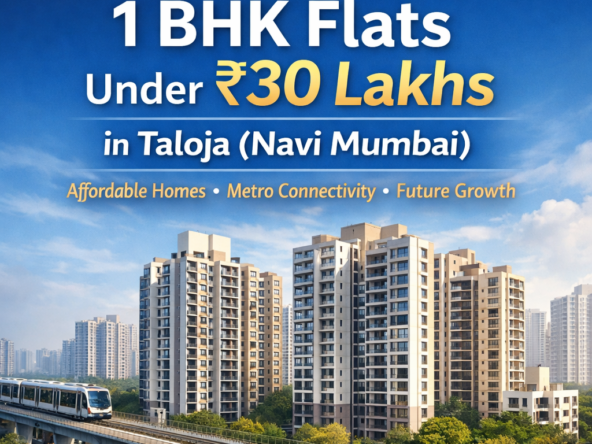

- Discuss the options available for NRIs in the residential sector, including apartments, villas, and independent houses.

- Highlight the growing demand for luxury apartments in metropolitan cities and the potential for rental income.

- Emphasize the importance of location, amenities, and resale value when choosing residential properties.

- Commercial Properties:

- Explain the various types of commercial properties NRIs can invest in, such as office spaces, retail shops, and commercial complexes.

- Discuss the advantages of investing in commercial real estate, including higher rental yields and long-term appreciation.

- Provide insights into emerging commercial hubs in India and the potential for steady rental income.

- Land and Plots:

- Explore the option of investing in land and plots for development or future appreciation.

- Discuss factors to consider when purchasing land, such as location, zoning regulations, and infrastructure development.

- Highlight the potential for significant returns on investment in land, especially in rapidly developing areas.

- Vacation Homes:

- Introduce the idea of investing in vacation homes or holiday properties in tourist destinations.

- Discuss the benefits of owning a vacation home, such as personal use, rental income, and potential appreciation.

- Provide tips for choosing the right vacation property, including proximity to tourist attractions and accessibility.

- Real Estate Investment Trusts (REITs):

- Explain the concept of REITs and how NRIs can invest in them to diversify their real estate portfolio.

- Discuss the advantages of investing in REITs, such as liquidity, professional management, and regular dividends.

- Highlight some popular REITs in India and their performance in the market.

Conclusion:

- Summarize the key points discussed in the article.

- Encourage NRIs to conduct thorough research and seek professional advice before making any real estate investments.

- Provide a call to action, inviting readers to explore further resources or contact experts for personalized guidance.

Remember to include engaging visuals, relevant statistics, and real-life examples to make the blog page informative and compelling for NRIs interested in real estate investment in India.

“Understanding Restrictions: Types of Properties NRIs Cannot Buy in India”

Introduction:

- Begin with a brief overview of the real estate market in India and the growing interest of NRIs (Non-Resident Indians) in investing in properties.

- Introduce the topic by discussing the legal restrictions and limitations faced by NRIs when it comes to purchasing certain types of properties in India.

Content Body:

- Agricultural Land:

- Explain the legal restrictions prohibiting NRIs from purchasing agricultural land in India, except in specific cases with government approval.

- Discuss the rationale behind these restrictions, including the protection of agricultural resources and the welfare of farmers.

- Provide insights into alternative investment options available to NRIs interested in agricultural activities, such as leasing or joint ventures.

- Plantation Property:

- Highlight the restrictions on NRIs acquiring plantation property, including tea estates, coffee estates, and agricultural land used for plantation purposes.

- Discuss the historical context and legal framework governing the ownership of plantation properties in India.

- Offer suggestions for NRIs interested in plantation investments, such as exploring partnerships with local entities or investing in related industries.

- Farmhouses:

- Explain the limitations on NRIs purchasing farmhouses or rural properties in India, typically imposed by state regulations.

- Discuss the reasons behind these restrictions, including concerns about land misuse, environmental conservation, and rural development.

- Provide information on alternative options for NRIs seeking countryside retreats or weekend homes, such as investing in approved residential projects or resorts.

- Restricted Areas:

- Highlight the areas designated as “restricted” or “prohibited” for property ownership by NRIs, often near international borders or sensitive zones.

- Explain the government regulations aimed at safeguarding national security and territorial integrity.

- Advise NRIs to exercise caution and conduct thorough due diligence before considering investments in areas with legal restrictions.

Conclusion:

- Summarize the key points discussed in the blog post regarding the types of properties NRIs cannot buy in India.

- Emphasize the importance of understanding legal restrictions and complying with regulations when investing in Indian real estate.

- Encourage NRIs to seek professional legal advice and guidance to navigate the complexities of property ownership laws in India.

End the blog with a call to action, inviting NRIs to explore further resources or consult legal experts for personalized assistance regarding real estate investments in India.