Buying a home in India is not just about choosing a flat.

It is about choosing a financial lifestyle for the next 15–30 years.

For most Indian families, the dream of owning a home becomes possible because of one thing —

Home Loan.

But here is the truth:

A home loan can build your future.

A wrong home loan can destroy your peace.

Most first-time buyers take loans without understanding:

- Real EMI pressure

- Long-term interest burden

- Lifestyle impact

- Financial risk

- Mental stress

They focus only on:

👉 “How much loan will I get?”

Instead of:

👉 “How much EMI can I live with peacefully?”

This blog will help you understand home loans in a real, practical, simple and smart way —

so that your home becomes a blessing, not a burden.

Home Loan Is Not Money — It Is a Long-Term Commitment

A home loan is not a financial benefit.

It is a long-term responsibility.

It means:

- Fixed EMI every month

- Reduced financial flexibility

- Long-term pressure

- Career and lifestyle impact

- Limited risk-taking ability

So the real question is not:

“How much loan can I get?”

The real question is:

“How much financial pressure can I handle peacefully for 20 years?”

The Biggest Mistake First-Time Buyers Make

This happens every day:

Bank says:

“You are eligible for ₹60 lakh loan.”

Buyer thinks:

“Great! Let’s buy a ₹65 lakh flat.”

This is the biggest trap.

Eligibility ≠ Affordability

Banks calculate risk.

You must calculate life comfort.

If EMI:

- Kills savings

- Removes emergency fund

- Creates stress

- Controls lifestyle

- Creates fear of job loss

Then the loan is dangerous, not helpful.

The Golden EMI Rule (Financial Safety Formula)

👉 EMI should not exceed 30–35% of monthly income

Example:

Income: ₹90,000/month

Safe EMI: ₹27,000–₹31,500

This ensures:

- Savings stay alive

- Emergency fund remains safe

- Lifestyle remains balanced

- Mental peace remains stable

Anything above this creates hidden stress.

How Banks Decide Your Loan Amount

Banks don’t see emotions.

They see numbers.

They evaluate:

- Monthly income

- Job stability

- Business income proof

- Age

- Existing EMIs

- Credit card usage

- CIBIL score

- Financial history

CIBIL Score Impact

- 750+ = Best interest rates

- 700–750 = Normal rates

- Below 650 = Risk category

Your CIBIL score alone can change:

- Interest rate

- Loan approval

- Loan amount

- Loan terms

Pre-Approved Loan = Smart Buyer Advantage

A pre-approved loan means:

The bank already trusts you financially.

Benefits:

- Faster deal closure

- Strong negotiation power

- Serious buyer image

- Builder confidence

- Better project access

Smart buyers always secure loan eligibility before property search.

EMI Trap vs Total Interest Reality

Most people focus only on EMI.

They ignore total repayment value.

Reality:

A ₹40 lakh loan for 20 years

Can easily become ₹80–90 lakh repayment.

Even 0.5% interest difference can cost lakhs over time.

So home loan planning is not EMI planning —

It is long-term financial planning.

Fixed vs Floating Interest: Real Truth

Fixed Rate

- Stability

- Higher initial interest

- Peace of mind

Floating Rate

- Lower starting EMI

- Market risk

- Rate fluctuation

Most long-term borrowers choose floating —

but must be mentally ready for EMI changes.

Emotional Buying + Big Loan = Financial Disaster

This is very common:

Family loves a flat

Emotion dominates logic

Loan size increases

EMI pressure increases

Savings disappear

Stress begins

Lifestyle suffers

Home buying can be emotional.

Loan taking must always be logical.

Right Order of Buying a Home

❌ Wrong order:

House → Loan → Stress

✅ Right order:

Loan capacity → Safe EMI → Budget → Location → House

This one change saves families from financial pressure for decades.

Why Smart Buyers Use Trusted Platforms

Random searching leads to:

- Wrong guidance

- Fake promises

- Price manipulation

- Confusion

- Risky decisions

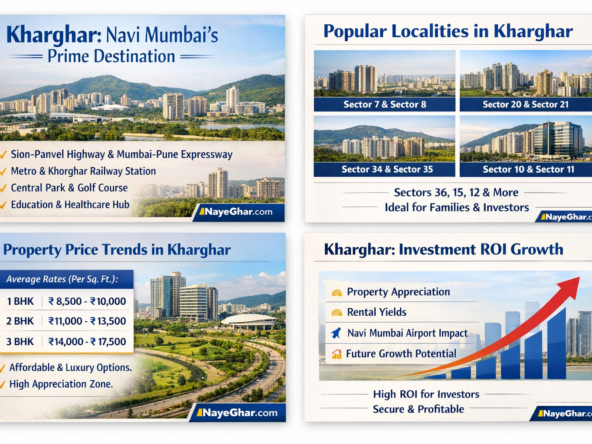

NayeGhar.com helps buyers with:

- Verified properties

- Trusted agents

- Transparent pricing

- Smart financial guidance

- Right decision support

Buying a home should feel secure, not confusing.

🔗 NAYEGHAR.COM INTERNAL LINKS (ANCHOR TEXT READY)

- Explore verified properties → NayeGhar.com Home Page

- Check affordable flats in your budget → Property Listing Page

- Talk to a property finance expert → Contact Page

- Register as a real estate agent → Agent Registration Page

- Join as a builder partner → Builder Success Plan Page