Buying your first home in India is a milestone that comes with excitement, pride, and a sense of long-term security. For many families, it is the biggest financial decision they will ever make. However, first-time home buyers often enter the market with limited knowledge, emotional pressure, or misleading information, which can lead to costly mistakes.

This detailed guide is created especially for first-time buyers to help you understand what truly matters before booking your dream home. If you follow these points carefully, you can avoid common risks and make a confident, informed decision.

Understand Your Budget Clearly Before You Start

Before browsing properties or visiting sites, you must clearly define how much you can afford. Many buyers focus only on the flat price and ignore additional costs, which later creates financial stress.

Your total budget should include stamp duty, registration charges, GST (for under-construction properties), parking charges, maintenance deposits, interiors, furniture, and moving expenses. Ideally, you should keep a buffer of at least 10–15% over the property price to manage unexpected costs comfortably.

Choose the Right Location for Long-Term Benefits

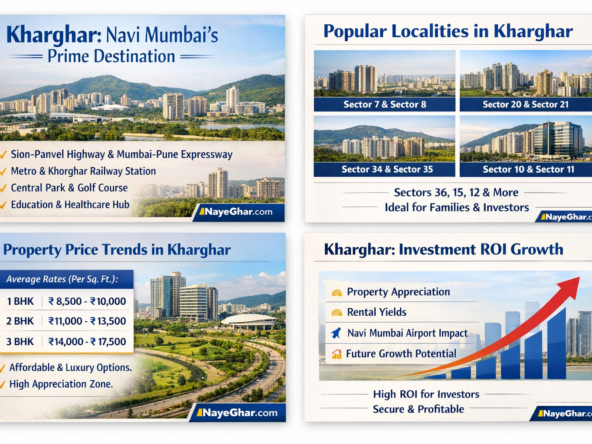

Location is not just about today’s convenience but also about tomorrow’s growth. A good location improves your lifestyle and ensures better resale or rental value in the future.

Look for areas with strong connectivity such as metro stations, highways, railway stations, and upcoming infrastructure projects. Access to schools, hospitals, markets, and offices plays a major role. Developing areas like Navi Mumbai often offer better appreciation compared to already saturated locations.

Decide Between a 1 BHK and a 2 BHK Wisely

Choosing the right home size is crucial. While a 1 BHK may seem budget-friendly, a 2 BHK offers more flexibility for growing families, work-from-home needs, and better resale value.

Think about your plans for the next 5–10 years. A slightly higher investment today can save you from shifting again in the future.

Verify All Property Documents Carefully

Never rely solely on brochures, ads, or verbal commitments. Property verification is one of the most important steps in home buying.

Ensure the project has a valid RERA registration number, clear title deed, approved layout plans, and required permissions from local authorities such as CIDCO or the municipal corporation. Buying a verified property protects you from legal disputes and delays.

RERA Approval Is a Must for Every Buyer

RERA was introduced to protect home buyers and improve transparency in the real estate sector. A RERA-approved project ensures that the builder follows defined timelines, clear carpet area norms, and proper disclosures.

Before booking any property, always check RERA details online and confirm the project’s registration status.

Compare Under-Construction and Ready-to-Move Properties

Both options have advantages and disadvantages. Under-construction properties are usually priced lower and offer better appreciation, but they involve waiting periods and GST costs.

Ready-to-move homes allow immediate possession and have no GST, but they are generally more expensive. Your choice should depend on your urgency, budget, and risk tolerance.

Plan Your Home Loan in Advance

Most first-time buyers depend on home loans. Planning early helps avoid last-minute surprises.

Maintain a good credit score, compare interest rates from multiple banks, and try to get a loan pre-approval before finalizing a property. This improves your negotiation power and ensures smoother processing.

Do Not Let Emotions Drive Your Decision

A beautifully furnished sample flat or a stylish brochure can influence emotions, but practical aspects matter more in the long run.

Check the carpet area, ventilation, sunlight, construction quality, water supply, and overall layout. Remember, emotional decisions fade, but EMIs last for years.

Prefer Zero Brokerage Property Platforms

Traditional brokerage adds unnecessary cost to your home purchase. Zero brokerage platforms eliminate middlemen and offer transparent pricing.

By choosing a zero brokerage platform, you can save a significant amount and directly access genuine, verified listings without hidden charges.

Always Buy Verified Property Listings

Fake listings and misleading ads are common in real estate. Verified property listings ensure that legal checks are completed, prices are genuine, and builders are trustworthy.

Platforms like NayeGhar.com focus on verified properties, making the home-buying journey safer and stress-free for first-time buyers.

Internal Links (Use Naturally Inside the Blog)

- Explore verified property listings on NayeGhar.com

- Browse zero brokerage flats in Navi Mumbai

- Check latest residential projects and offers

Frequently Asked Questions

What is the ideal age to buy a first home in India?

Most experts suggest early 30s due to stable income and better loan eligibility.

Is buying an under-construction property safe?

Yes, if the project is RERA approved and properly verified.

How much down payment is required?

Generally, 15–20% of the total property value.

What documents should I verify before booking?

RERA registration, title deed, approved plans, and authority approvals.

Do first-time home buyers get tax benefits?

Yes, tax benefits are available under Sections 80C and 24(b).

Is zero brokerage really free for buyers?

Yes, buyers do not pay any commission.

Call to Action

👉 Call / WhatsApp: 9321605435

👉 Explore Verified Properties on NayeGhar.com