Buying a home is one of the most important financial and emotional decisions of your life. It is not just about owning a property—it is about securing your family’s future, comfort, and peace of mind.

However, without the right knowledge and planning, home buying can quickly turn stressful due to hidden costs, legal issues, or poor location choices.

This complete guide will help you understand everything a home buyer should know before purchasing a property in India.

1. Fix Your Budget Before You Start Searching

The first and most crucial step in home buying is deciding your budget.

Many buyers make the mistake of selecting a property first and worrying about affordability later. This often leads to financial pressure due to high EMIs.

What to include in your budget:

- Monthly income and expenses

- EMI should ideally not exceed 30–40% of your monthly income

- Down payment amount

- Registration, stamp duty, and GST

- Future expenses like maintenance and lifestyle costs

A well-planned budget ensures long-term financial stability.

2. Choose Zero Brokerage Homes

Brokerage can add a significant and unnecessary cost to your home purchase. Today, many verified platforms offer zero brokerage properties, allowing buyers to deal directly with builders.

Benefits of zero brokerage homes:

- Saves lakhs of rupees

- Transparent pricing

- Direct communication with builders

- Better negotiation opportunities

Choosing zero brokerage homes helps you invest more in your property rather than paying middlemen.

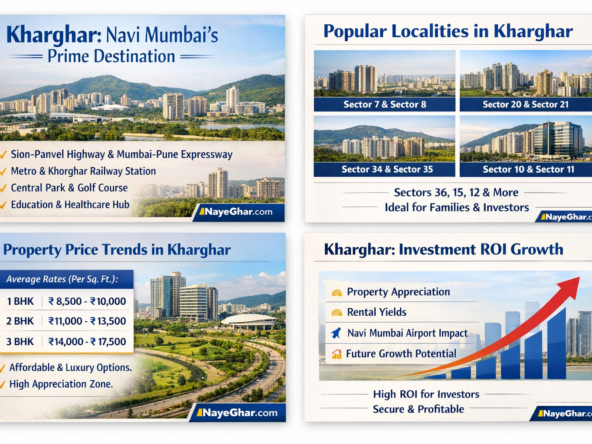

3. Select the Right Location Carefully

Location plays a vital role in both your daily convenience and future property value.

Key factors to consider:

- Metro or railway connectivity

- Schools, colleges, and hospitals nearby

- Markets and essential services

- Office commute time

- Upcoming infrastructure projects

A good location improves quality of life and increases resale and rental value.

4. Always Do a Proper Site Visit

Never book a home based only on brochures, images, or online listings.

During a site visit, check:

- Natural light and ventilation

- Actual carpet area

- Construction quality

- Amenities and open spaces

- Surrounding neighborhood

Visiting the site gives you clarity and prevents future disappointment.

5. Ask Clearly About Hidden Charges

Many builders quote a base price that does not include additional costs. These extra charges can significantly increase your total payment.

Common hidden charges include:

- Maintenance charges

- Parking fees

- Clubhouse or amenities charges

- Electricity and water connection fees

- GST and registration costs

Always ask for the all-inclusive price in writing.

6. Read the Agreement Carefully

The sale agreement is a legally binding document. Never sign it without understanding every clause.

Pay special attention to:

- Possession date and delay penalty

- Carpet area (not super built-up area)

- Payment schedule

- Cancellation and refund policy

- Maintenance terms

If needed, consult a legal expert before signing.

7. Buy Only RERA Approved Projects

RERA (Real Estate Regulatory Authority) was introduced to protect home buyers and ensure transparency.

Benefits of RERA approved projects:

- Legal security

- Timely possession

- Builder accountability

- Verified project details

Avoid investing in projects without a valid RERA registration number.

8. Get Home Loan Pre-Approval

Home loan pre-approval helps you understand how much loan you are eligible for before selecting a property.

Advantages of pre-approval:

- Clear budget planning

- Faster booking process

- Stronger negotiation position

- Reduced chances of loan rejection

Most banks and NBFCs provide easy pre-approval options today.

9. Choose Verified Properties Only

Not all property listings are genuine. Buying an unverified property can lead to legal disputes and financial losses.

Verified properties ensure:

- Clear legal titles

- Verified builder background

- Authentic documentation

- Fair and transparent pricing

Always use trusted and verified real estate platforms.

10. Think Long-Term, Not Just Today

Your home is a long-term investment, often for 20–30 years.

Consider:

- Future family needs

- Children’s education

- Job changes

- Area development potential

- Resale and rental value

A future-focused decision ensures lasting satisfaction.

Conclusion

Buying a home is a life-changing decision. With proper planning, verified information, and smart choices, you can avoid common mistakes and secure a safe, comfortable future.

If you fix your budget, choose zero brokerage homes, buy RERA approved projects, and carefully read agreements, you are already ahead of most buyers.

A smart home buyer is an informed home buyer.

Frequently Asked Questions (FAQs)

1. What is the ideal EMI percentage of income for home buyers?

EMI should ideally be limited to 30–40% of your monthly income.

2. What does zero brokerage mean?

Zero brokerage means buyers do not pay any commission to property agents or brokers.

3. Why is RERA approval important?

RERA approval ensures legal security, transparency, and timely possession.

4. What are hidden charges in home buying?

Hidden charges include maintenance fees, parking, GST, registration, and utility charges.

5. What is carpet area?

Carpet area is the actual usable area inside the flat, excluding walls and common spaces.

6. Should I visit the property site before booking?

Yes, a site visit is essential to check construction quality, surroundings, and actual flat size.

7. What is home loan pre-approval?

It is a confirmation from a bank about the loan amount you are eligible for.

8. How can I verify a property legally?

Check RERA registration, title documents, and use verified property platforms.

9. Is location more important than price?

Yes, a good location offers better lifestyle convenience and long-term value appreciation.

10. Is buying a home a good investment?

Yes, if chosen wisely, a home provides security, appreciation, and rental income.