Real Estate Trends in India 2024: A Comprehensive Guide

The real estate market in India is evolving rapidly, influenced by various economic, political, and social factors. In 2024, several trends and opportunities are shaping the landscape, making it essential for investors, homebuyers, and industry professionals to stay informed. This comprehensive guide will explore the key aspects of the real estate market in India, offering insights into residential and commercial sectors, government policies, and emerging markets.

Residential Real Estate Market in India: Current Trends and Predictions

The residential real estate market in India has seen a resurgence in recent years, driven by increasing urbanization, rising incomes, and changing lifestyle preferences. In 2024, this sector is expected to grow further, with a focus on:

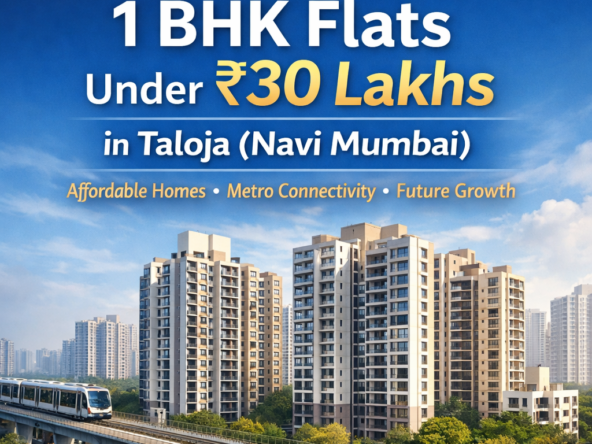

- Affordable Housing: Government initiatives and subsidies continue to make affordable housing more accessible. Cities like Mumbai, Pune, and Hyderabad are seeing new developments catering to middle-income buyers.

- Luxury and Premium Segments: High-net-worth individuals (HNIs) are driving demand for luxury homes. The trend of gated communities, smart homes, and premium apartments is on the rise in metros like Delhi and Bangalore.

- Sustainable and Green Living: There is a growing demand for eco-friendly homes that offer sustainable living solutions. Builders are incorporating green building materials, rainwater harvesting, and solar panels to meet this demand.

Commercial Real Estate Opportunities in India: What Investors Need to Know

The commercial real estate sector in India is witnessing a robust expansion, propelled by economic growth and an increasing number of startups and multinational corporations setting up offices. Key opportunities include:

- Co-working Spaces: The rise of the gig economy and flexible work models has led to a surge in demand for co-working spaces in major cities like Mumbai, Bangalore, and Gurgaon.

- Retail Spaces: The retail sector is experiencing a boom, with e-commerce giants and traditional retailers expanding their brick-and-mortar presence. Malls and high-street retail spaces in Tier 1 and Tier 2 cities are prime investment areas.

- Warehousing and Logistics: The growth of e-commerce has increased the demand for warehousing and logistics hubs. Strategic locations near ports and industrial corridors are becoming hotspots for investment.

Impact of Government Policies on the Indian Real Estate Sector

Government policies play a crucial role in shaping the real estate market. Several initiatives and regulations are expected to impact the sector positively in 2024:

- Real Estate Regulatory Authority (RERA): RERA continues to bring transparency and accountability, making it safer for buyers and investors. Developers are now more compliant with project timelines and quality standards.

- Goods and Services Tax (GST): The streamlined GST regime has simplified tax structures, making it easier for builders and homebuyers to understand the costs involved in property transactions.

- Pradhan Mantri Awas Yojana (PMAY): This scheme aims to provide affordable housing to all by 2022, with an extension in its implementation timeline. It offers credit-linked subsidies and other incentives, making homeownership more achievable for the urban poor.

Affordable Housing Schemes in Major Indian Cities

Affordable housing remains a key focus area for both the government and private developers. Cities like Mumbai, Delhi, Chennai, and Kolkata are seeing new projects under affordable housing schemes. These initiatives provide:

- Subsidized Loans: Lower interest rates and easy loan access for first-time homebuyers.

- Tax Benefits: Various tax exemptions are available for affordable housing projects, benefiting both developers and buyers.

- Incentives for Developers: Reduced land acquisition costs and faster project approvals are encouraging more builders to enter the affordable housing segment.

The Role of RERA in Regulating Real Estate Transactions in India

RERA has been a game-changer for the real estate industry in India. Its implementation has brought significant changes, including:

- Transparency: Developers are required to register their projects with RERA, providing all details about project timelines, approvals, and completion dates. This reduces the risk of project delays and fraud.

- Buyer Protection: RERA ensures that homebuyers’ interests are protected, with strict penalties for developers who fail to deliver projects as promised.

- Fair Practices: Standardized agreements and clear terms have become the norm, ensuring fair dealings between developers and buyers.

Top Emerging Real Estate Markets in India for 2024

While metros like Mumbai, Delhi, and Bangalore continue to dominate the real estate market, several emerging cities are showing great potential in 2024:

- Pune: With its thriving IT industry and educational institutions, Pune is becoming a preferred destination for real estate investments.

- Hyderabad: Known for its robust infrastructure and business-friendly environment, Hyderabad is attracting investments in both residential and commercial real estate.

- Kolkata: Affordable property prices and improving connectivity are making Kolkata an attractive option for real estate developers and investors.

Tips for First-Time Homebuyers in India

Buying a home for the first time can be a daunting task. Here are some tips to help first-time homebuyers make informed decisions:

- Research Thoroughly: Understand the real estate market trends and explore various options before making a decision.

- Check RERA Registration: Ensure the project is registered with RERA to avoid any legal or financial issues.

- Budget Wisely: Calculate your budget, including down payment, home loan EMI, and other associated costs. It’s crucial to stay within your financial limits.

- Inspect the Property: Visit the site to check the construction quality, amenities, and location. Don’t rely solely on brochures or online information.

How to Choose the Right Real Estate Investment in India

Investing in real estate is a significant decision that requires careful consideration. Here’s how you can choose the right investment:

- Location: Consider properties in areas with good connectivity, infrastructure, and proximity to schools, hospitals, and shopping centers.

- Developer Reputation: Research the developer’s track record, previous projects, and customer reviews.

- Potential for Appreciation: Invest in areas that show potential for property value appreciation, such as upcoming industrial zones, IT hubs, or areas with planned infrastructure projects.

- Rental Yield: If you’re looking for rental income, choose locations with high demand for rental properties, such as near business districts or universities.

This guide provides a comprehensive overview of the real estate market in India for 2024, offering valuable insights for buyers, investors, and industry professionals. By staying informed and understanding the market dynamics, you can make well-informed real estate decisions.